Read? Investing is best seen as a hobby

"This is why I am now recommending a retirement fund separate from an investment fund for those of us who are keen to invest during our retirement years. The retirement fund will take care of our daily needs. Ideally, the capital in this retirement fund will be sufficient to last us our entire life. With this retirement fund in place, you will take the pressure off the investment fund to perform. Like it or not, no one can predict how quickly our investments will mature and putting pressure on yourself for something totally out of your control will be certainly detrimental to your financial health, especially during your retirement years." - Dr Leong

Uncle8888 agreed with his recommendations too. This is somewhat quite similar to what he has planned for.

Read? Work Less and Gone Fishing Planning Room (7)

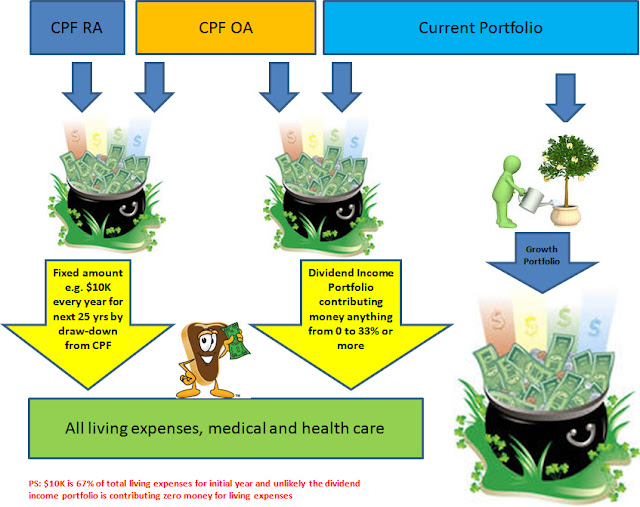

Uncle8888 has set up three Money Pots for his retirement needs.

The first money pot is from CPF OA/CPF RA. It will be able to meet at least 67% of his living expenses at 2.5% inflation rate up to 80 years old.

No comments:

Post a Comment