Read? Retirement Income for Life??? (4)

Requirements for Retirement – How Much is Enough?

May be we can make reference to Singapore Department of Statistic's Household Expenditure Survey in 2007/2008 which determined the average monthly household consumption expenditure.

In this survey, household consumption expenditure was defined as "the value of consumer goods and services acquired, used or paid for by a household for the satisfaction of the needs and wants of its members" on a monthly basis.

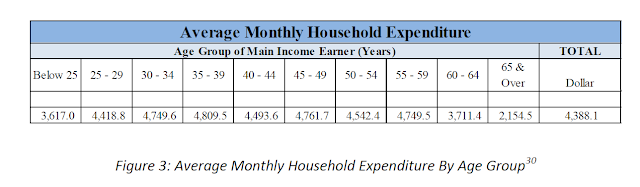

The average monthly expenditure per household by age group as below:

It has been assumed that the typical household of those aged 65 and over contains two people.

For those aged 65 and over, the average household expenditure was $2,154.50 in 2007/2008.

Basically, we can add in annual inflation rate of 3-5% and plus some buffer to derive our own household expenditure for two old couple.

It really doesn't work like that for us. We find that the 1st year we stop the rat race, we have too much time on our hand, therefore we spend more money to kill time, instead of exchanging our time for money. We actually spend more than when one of us was still working.

ReplyDeleteSo you will spend more when you stop working not less. At least for the 1st few years, where your health still permit.

Later into retirement, you may spend less on leisure but more on health matter. With God blessings you may not need to spend much on health matter. Of course we must try to keep our health. As we know God can't help us if we don't want to help ourselves. Even then, any thing is possible concerning a person's health.

True. First X yrs into the retirement, we will want to see more of the other sides of the World so it is likely to be spending more.

Delete