Telegram messaging service to allow Tether stablecoin payments

-

TETHER, the issuer of the world’s most used stablecoin, has teamed up with

TON Foundation to allow customers to send crypto payments using the popular

Tele...

54 minutes ago

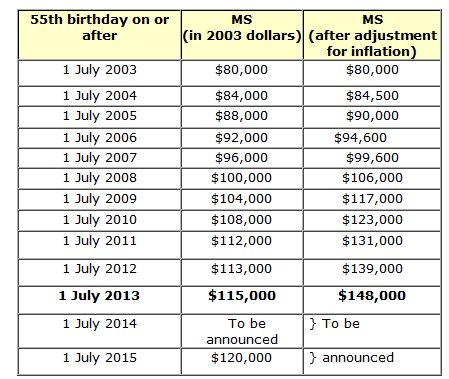

So we can use 3% inflation rate to estimate Retirement Income for Life.

ReplyDelete